This is a guest post written by Steve L. Wintner, AIA, Emeritus, an architecture management consultant and co-author of the book, Financial Management for Design Professionals: The Path to Profitability. To learn more about Steve, his firm Management Consulting Services or to dive deeper into the subject that Steve is sharing with us here at EntreArchitect, visit his website at ManagementConsultingServices.com.

The Financial Management Cycle

Effective financial management is a continuous, cyclical process. In setting up a financial management system, at what point and with what should you begin?

An annual budget is developed on the basis of information contained in past financial reports. Financial reports use the budget as a benchmark for measuring actual financial performance. So which comes first? How do you develop an annual budget if you don’t have good historical data? What good are the financial reports without a reliable budget to compare them to?

To answer these rhetorical questions, the point in time at which to begin, if you haven’t already done so, is now, and the first step is to establish and implement an effective Chart of Accounts.

Your Chart of Accounts is The Hub of Your Financial Management Cycle

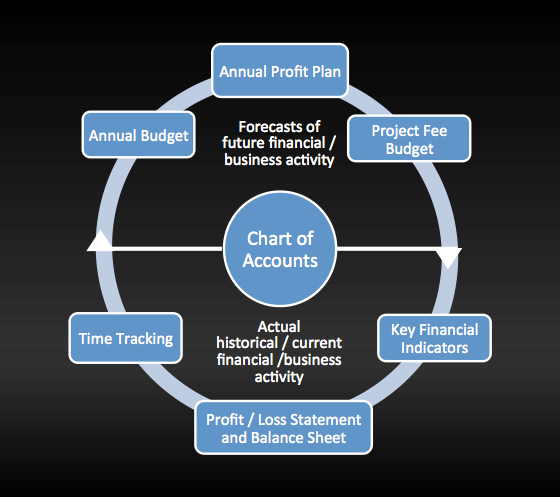

It’s helpful to visualize the financial management cycle in the form of a wheel. Like all good wheels it needs a strong hub. The hub of the financial management cycle is the Chart of Accounts, around which revolve two halves of the wheel. The lower half consists of the elements that make up the historic/actual/current financial and business activity of the firm, while the upper half consists of the elements used to forecast the future financial and business activity of the firm. Take away any part of the wheel, and it collapses—all of the parts are needed to make a complete wheel.

Financial reports are always a record of past financial and business activity, regardless of how recent that activity may be, or how brief the historical period.

Annual budgets, annual profit plans, and individual project fee budgets are forecasts of future financial and business activity.

When you have reliable historical data from past financial reports, those forecasts become informed forecasts, rather than simply best guesses. An informed financial forecast—whether it is an annual budget and profit plan for the firm or a project fee budget for an individual project—then serves as the benchmark for measuring your firm’s actual business and financial activity.

As your record of past historical and financial activity grows, the quality and accuracy of your forecasts of future financial and business activity will improve. But none of these tools of financial management—financial forecasts or financial reports—are of any use unless your financial management system is built on a Chart of Accounts designed to measure the true profitability of your professional design firm, which would be The P2P Format system.

More from Steve L. Wintner, AIA, Emeritus

Financial Management for Architects (blog)

Financial Management for Architects (blog)

How To Fix Your Profitability Problem as a Small Firm Architect (blog)

Why Architects Are NOT Properly Prepared to Own and Operate an Architecture Firm (blog)

6 Reasons Why Architects Are Not Earning the 20% Profit They Need (blog)

The 6 Critical Steps to a Profitable Architecture Firm (blog)

7 Key Financial Performance Indicators for a Successful Architecture Firm (blog)

Developing a Time Management Discipline (blog)

How To Establish a Culture of Accountability (podcast)

A Culture of Accountability (EntreArchitect Master Class – Members Only – Join Now)

Planning for Profit (EntreArchitect Master Class – Members Only – Join Now)

Steve L. Wintner, AIA, Emeritus, a licensed architect), retired (1968-1985). Over the course of his 60-year career, Steve served as the managing principal of a small firm partnership and later as the VP/Director of Operations for two of the largest architectural firms in the country, at that time. Retiring from active practice in 1985, Steve started his second career as a management consultant, with a commitment to make a difference in the professional design industry by assisting other design professionals achieve their goals through his body of knowledge and experience as a managing architect.

Steve’s commitment to the profession has lead to developing a series of professional development workshops which have been presented to national, state and local AIA components, and individual professional design firms, since 1993. His financial management workshop, titled, ‘The Path to Profitability’ became the basis of the book he co-authored with Michael Tardif, Assoc. AIA, Financial Management for Design Professionals: The Path to Profitability . The second printing of the expanded book will be self-published in 2017, as an e-book, or as a hard copy, on request.

Mark, thank you for publishing this for your members.

Regards,

Steve