A Most Important Habit for Success

Without any education in business basics, architects rarely understand the fundamentals of business success. Some months we have money left over and other months we struggle to pay each bill.

For years, I ran my business with no real understanding of how to end each month with a profit.

Seven years into owning our own small firm, Annmarie and I decided to make some changes. It was during that year when I committed to a business program offered by Westchester Community College titled the Academy of Entrepreneurial Excellence. I wrote about my experience at the Academy in the introduction to my original Entrepreneur Architect Academy blog series back in 2013.

One of the most important habits I developed during that year is the preparation of a financial schedule. During the first two business days every month I prepare my client invoices (receivables), pay my bills (accounts payable), reconcile my bank accounts and credit card statements and review my financial statements.

Before I scheduled these tasks, I found that I would fit them in around project deadlines and client meetings. I would often lose track of receivables, send them out late and be caught short with little cash in the bank to pay the bills. Other than a quick peek at the checking balance, I had no clue to the health of the business.

Understanding how to prepare and read my financial statements changed everything. As a small firm architect with no investors, I use my accounting software to prepare two simple financial reports; my balance sheet and my income statement.

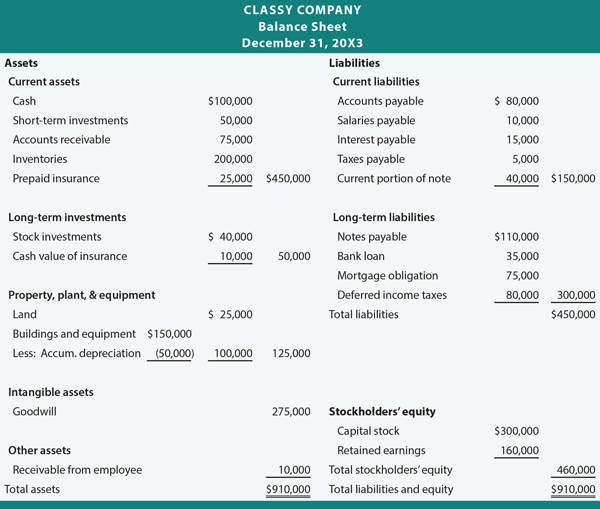

Balance Sheet (Assets = Liabilities + Shareholders’ Equity)

My balance sheet shows my financial position for a specific moment in time. Like a snapshot of my firm’s financial health, it identifies my firm’s assets such as cash, inventory, property owned, etc. and it’s liabilities, which are my debt, accounts payable, etc.

At its simplest form, the balance sheet tells me what I have and where it came from. The statement is an expanded balanced equation where my assets (what I have) equals liabilities (what I borrowed) plus shareholder’s equity (what I or other shareholders invested).

(sample balance sheet)

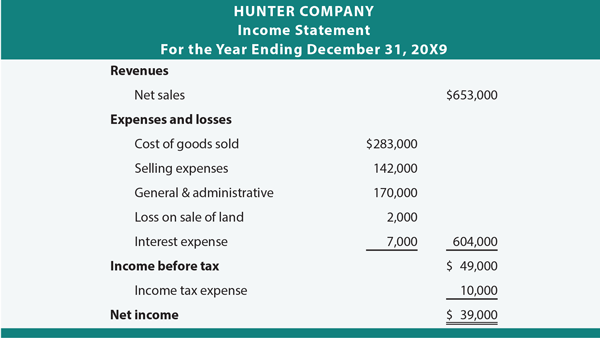

Income Statement (Revenues – Expenses = Net Income)

Where the balance sheet shows my firm’s health, the income statement is the primary measure of my firms performance. This report shows my firm’s revenues less expenses for a period of time. Also known as the profit/loss statement, my income statement measures my success in collecting more fees than my cost to generate those fees.

My income statement shows my total revenues categorized as Architectural Services Fees, Construction Management Services Fees, Consulting Fees, Sub-Tenant Rent Income and Reimbursable Expenses.

Then my business expenses are listed and subtracted from the total revenues, providing my pre-tax income. Subtracting the income tax expense gives me my net income, also known as profit.

(sample income statement)

Knowing the health of my business at any moment in time, as well as the overall performance on a month to month basis allows me to plan my future and prepare for success.

If you want to learn more about financial planning for architects, come join us at EntreArchitect Academy. Our Academy libraries include videos and resources to help you build a complete financial system, and our first Academy Expert Training was presented by Rena Klein, FAIA, author of The Architect’s Guide to Small Firm Management: Making Chaos Work for Your Small Firm.

Question: Do you prepare financial statements? Have they helped you succeed?

photo credit: shutterstock/kos1976

Sample Statements via http://www.principlesofaccounting.com

Leave a Reply