Without any education in business basics, architects rarely understand the fundamentals of business success. Some months we have money left over and other months we struggle to pay each bill.

Without any education in business basics, architects rarely understand the fundamentals of business success. Some months we have money left over and other months we struggle to pay each bill.

For years, I ran my business with no real understanding of how to end each month with a profit.

Seven years into owning our own small firm, Annmarie and I decided to make some changes. It was during that year when I committed to a business program offered by Westchester Community College titled the Academy of Entrepreneurial Excellence. I wrote about my experience at the Academy in my Introduction to the Entrepreneur Architect Academy blog series this past winter.

One of the most important habits I developed during that year is the preparation of a financial schedule. During the first two business days every month I prepare my client invoices (receivables), pay my bills (accounts payable), reconcile my bank accounts and credit card statements and review my financial statements.

Before I scheduled these tasks, I found that I would fit them in around project deadlines and client meetings. I would often lose track of receivables, send them out late and be caught short with little cash in the bank to pay the bills. Other than a quick peek at the checking balance, I had no clue to the health of the business.

Understanding how to prepare and read my financial statements changed everything. As a small firm architect with no investors, I use Quickbooks Pro software and prepare two simple financial reports; my balance sheet and my income statement.

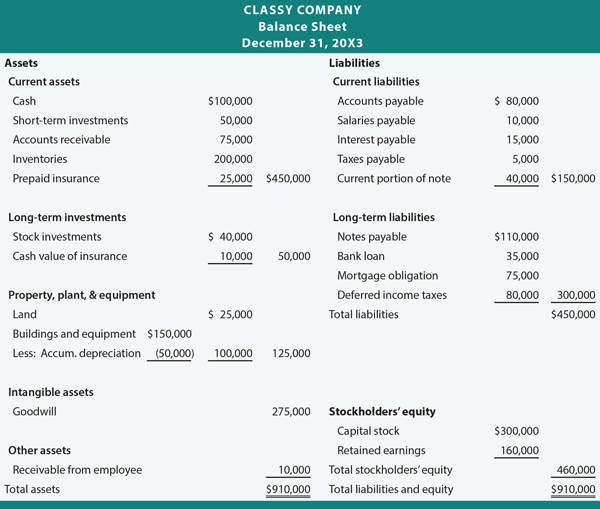

Balance Sheet (Assets = Liabilities + Shareholders’ Equity)

My balance sheet shows my financial position for a specific moment in time. Like a snapshot of my firm’s financial health, it identifies my firm’s assets such as cash, inventory, property owned, etc. and it’s liabilities, which are my debt, accounts payable, etc.

At its simplest form, the balance sheet tells me what I have and where it came from. The statement is an expanded balanced equation where my assets (what I have) equals liabilities (what I borrowed) plus shareholder’s equity (what I or other shareholders invested).

(sample balance sheet)

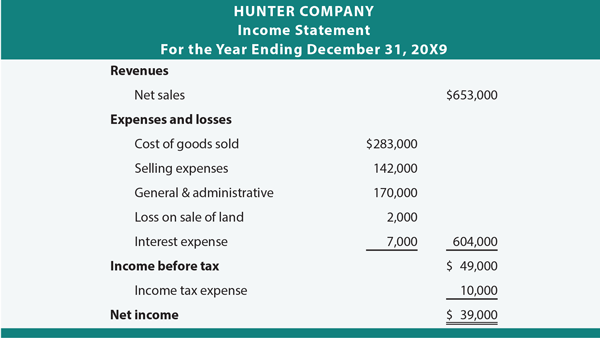

Income Statement (Revenues – Expenses = Net Income)

Where the balance sheet shows my firm’s health, the income statement is the primary measure of my firms performance. This report shows my firm’s revenues less expenses for a period of time. Also known as the profit and loss statement, my income statement measures my success in collecting more fees than my cost to generate those fees.

My income statement shows my total revenues categorized as Architectural Services Fees, Construction Management Services Fees, Consulting Fees, Sub-Tenant Rent Income and Reimbursable Expenses.

Then my business expenses are listed and subtracted from the total revenues, providing my pre-tax income. Subtracting the income tax expense gives me my net income, also known as profit.

(sample income statement)

Knowing the health of my business at any moment in time, as well as the overall performance on a month to month basis allows me to plan my future and prepare for success.

If you want to learn more about financial planning for architects, check out Session 007 of the Entrepreneur Architect Academy. My friend Steven Burns, FAIA wrote a three-part guest post, teaching us the financial basics of business success.

Do you prepare financial statements? Have they helped you succeed?

***

photo credit: kenteegardin via photopin cc

Sample Statements via http://www.principlesofaccounting.com

Yes! I taught interior design students this for more than 16 years. The commonly used text in that field has several chapters on financial reporting & analysis with specific sections explaining balance sheets, income statements, cash flow reports, and outlining the differences between cash and accrual bases for reporting financial activities. Sadly, this was not included in the pro practice course offered when I was a senior in architecture school. Also, we did not use a textbook, but I’m not sure I’ve seen as much coverage of this essential topic in any but a few specialized tomes in our field. I had to acquire it on my own, once I entered practice. Maybe this has changed recently. I wonder how many of your readers encountered this in their pro practice courses. Thoughts, recollections, comments, anybody?

Good post ! Without knowing the real cost of doing business, many architects are operating in the dark and they keep lowering fees; or expanding project scope without solid compensation. Shrewd clients and developers are aware of this weakness and they have learned to profit from it by playing one architect against another.

What does $275,000.00 in goodwill represent?

Goodwill in an intangible asset. It is meant to account for the value of the firm minus the assets of the firm like cash, equipment, investments, software, etc. I think of it as the value of the firm’s ability to make money in the future. If you had a firm and were trying to sell it to someone, you would expect it to be worth more than the physical assets. There is recognizable branding, existing relationships, and other intangible things that YOU KNOW are going to help this business in the future, and you want this to be recognized, valued, and paid for.

When Disney bought Star Wars about half of what they paid was for Goodwill, and the other half was real assets. This is because they were paying for the name. They would not have done as well if they would have made some other sci-fi/fantasy series. They paid for the name. Coca-Cola would be similar.

Great post introducing the business and financial aspect of a small architecture firm! Recently read another post discussing the financial aspect of architecture on Architizer, which looked at another program called ArchiOffice to help us “architects” be better at business … http://www.architizer.com/blog/bqe-archioffice-software/

Quickbooks Pro vs. ArchiOffice?

Interesting you ask that question. Steven Burns, FAIA is Director of Product Strategy and Innovations at BQE Software, makers of ArchiOffice. Check out his series of guest posts at http://www.entrearchitect.com/2013/02/17/entrepreneur-architect-academy-007-1-how-to-become-the-richest-architect-you-know-part-1-of-3/. Maybe I can convince Steve to come back and write a post comparing the two software packages and the advantages of each.

Great post. I gave up a career as a bookkeeper/accountant so I can pursue a career in architecture, and now that I am running an architecture firm, I find I’m doing more accounting than architecture anyways. It is definitely a skill you need to be a successful Entrepreneur Architect.

I’ve had a small practice for over 20 years -up to 6 staff at one point, but now solo. I finally took a Marketing course just recently that addresses all of these issues. I sure wish I had learned this in college or at least in the first 5 years of practice. Why is this not required as part of architectural education??? Even non-owner staff needs to understand how their performance affects the bottom line.